Pubblicazioni

Grantmaking, Grading on a Curve, and the Paradox of Relative Evaluation in Nonmarkets (in corso di pubblicazione)

Jerome Adda and Marco Ottaviani

Quarterly Journal of Economics

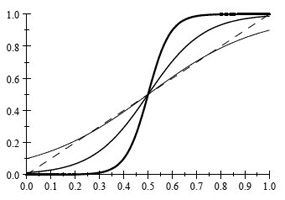

Model of nonmarket allocation of resources such as the awarding of grants to meritorious projects, honors to outstanding students, or journal slots to quality publications.

Key theoretical novelty: Lehmann (1988) information as a tractable tool for general comparative statics.

Main prediction of the model: Participation in a field increases as evaluation in that field becomes noisier & as evaluation in other fields becomes less noisy.

Key empirical result: Prediction confirmed in the data exploiting 2014 change in budget apportionment rule at the ERC.

When Liability is Not Enough: Regulating Bonus Payments in Markets With Advice (in corso di pubblicazione)

Jun Honda, Roman Inderst, and Marco Ottaviani

Management Science

In a number of markets, competing product providers compensate sales agents and advisors through nonlinear incentive schemes with bonuses. How should policy makers regulate nonlinear incentives in markets with advice? Is it enough to step up liability or should the shape of the compensation structure of advisors be regulated more directly?

Approval Regulation and Learning, with Application to Timing of Merger Control (in corso di pubblicazione)

Marco Ottaviani and Abraham Wickelgren

Journal of Law, Economics, and Organization

The paper casts the tradeoff between ex-ante regulation (based on limited information about sign and magnitude of externality) and ex-post policy intervention (involving costly reversion) as a collective experimentation problem. (Winner of the 2009 Robert F. Lanzillotti Prize for best paper in antitrust economics at the International Industrial Organization Conference)

Looking into Crystal Balls: An Experiment on Reputational Cheap Talk (01/09/2023)

Debrah Meloso, Marco Ottaviani, and Salvatore Nunnari

Management Science, 69(9), 5112–5127.

Do experts motivated by their reputation for being well informed have an incentive to misreport their information? As predicted by reputational cheap talk theory, experts are more likely to report truthfully when the state of the world is more uncertain and when evaluators conjecture that reporters always report truthfully. However, evaluators have difficulty learning experts' strategies and tend to overreact to message accuracy, exacerbating experts' incentives to misreport.

Regulation with Experimentation: Ex Ante Approval, Ex Post Withdrawal, and Liability (01/07/2022)

Emeric Henry, Marco Loseto, and Marco Ottaviani

Management Science, 68(7): 5330-5347.

Tractable continuous-time model to study the optimal mix of the three instruments regulators employ to align the private incentives of firms: ex ante approval regulation, ex post withdrawal regulation, and liability. Results can rationalize the array of regulatory environments observed across applications ranging from product safety to competition policy.

Strategic Sample Selection (2021)

Alfredo Di Tillio, Marco Ottaviani, and Peter N. Sorensen

Econometrica, 89(2), 911-953.

Link to VIDEO presentation of core idea at Berkeley's Simons Institute (minutes 3-22)

Evaluates the welfare impact of sample selection, with applications to information aggregation in auctions, examinee choice in educational testing, manipulation of evidence in statistical inference, and peremptory challenge in juries.

- Strategic Sample Selection (431 Kb)

P-Hacking in Clinical Trials and How Incentives Shape the Distribution of Results across Phases (16/05/2020)

Jerome Adda, Christian Decker, and Marco Ottaviani

Proceedings of the National Academy of Sciences, 117 (24) 13386-13392.

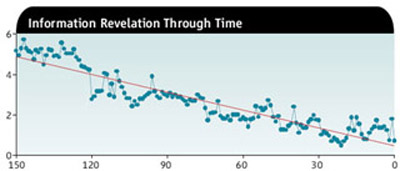

Systematic analysis of p-values reported to the ClinicalTrials.gov registry reveals:

(i) no cluster of results just above the significance threshold [good news about integrity of reported trials]

(ii) sponsors with more favorable phase II results are more likely to continue to phase III investigations [incentives matter], and

(iii) part of the excess amount of phase III significant results relative to phase II remain unexplained for small industry sponsors [this suspicious pattern is consistent with some selective reporting and suggests the need of tightening enforcement of registration regulation, especially for small industry sponsors].

- P-Hacking in Clinical Trials and How Incentives Shape the Distribution of Results across Phases (1.737 Kb)

- presentation (694 Kb)

Persuasion through Selective Disclosure: Implications for Marketing, Campaigning, and Privacy Regulation (2020)

Florian Hoffmann, Roman Inderst, and Marco Ottaviani

Management Science, 66(11), 4958–4979.

Model of equilibrium persuasion through selective disclosure. Positive and normative implications depending on: the extent of competition among senders, whether receivers are wary of senders collecting personalized data, whether firms are able to personalize prices, and whether receivers make individual or collective decisions.

Research and Approval Process: The Organization of Persuasion (2019)

Emeric Henry and Marco Ottaviani

American Economic Review, 109(3): 911-955.

Organizational deconstruction of Wald's model of sequential information acquisition, bridging experimentation with persuasion. The payoff and control rights of a statistician (planner) are split between an evaluator and an informer. The informer provides costly information with the aim of persuading the evaluator to approve. Welfare analyis + application to approval regulation, including FDA's supervision of clinical trials.

Persuasion Bias in Science: Can Economics Help? (2017)

Alfredo Di Tillio, Marco Ottaviani, and Peter Norman Sorensen

Economic Journal, 127 (October), F266–F304.

A researcher aims at persuading an evaluator that the causal effect of a treatment outweighs its cost, so as to justify acceptance. The researcher uses private information to (1) sample subjects based on their treatment effect (challenging external validity), (2) assign subjects to treatment based on their baseline outcome (challenging internal validity), or (3) selectively report experimental outcomes (challenging both external and internal validity).

Persuasion Bias in Science: Can Economics Help?

Price Reaction to Information with Heterogeneous Beliefs and Wealth Effects: Underreaction, Momentum, and Reversal (2015)

Marco Ottaviani and Peter Norman Sorensen

American Economic Review, 105 (1): 1-34, January 2015.

(supersedes previous paper titled: "Aggregation of Information and Beliefs: Asset Pricing Lessons from Prediction Markets")

When traders with heterogeneous prior beliefs can invest a limited amount of money (or their absolute risk aversion is decreasing in wealth), the equilibrium price under-reacts to information.

Accept or Reject? An Organizational Perspective (2014)

Umberto Garfagnini, Marco Ottaviani, and Peter Norman Sørensen

International Journal of Industrial Organization, 34: 66-74, May 2014

How should an informed principal decide based on the advice of an informed but biased party?

The Flip Side of Financial Synergies: Coinsurance versus Risk Contamination (2013)

Albert Banal Estanol, Marco Ottaviani and Andrew Winton

Review of Financial Studies, 26 (12): 3142-3181, December 2013.

Characterizes tradeoff between co-insurance and risk contamination with debt financing and default costs, depending on the bankruptcy recovery rate, the mean, the variability, the skewness, and the correlation of returns.

Sales Talk, Cancellation Terms, and the Role of Consumer Protection (2013)

Roman Inderst and Marco Ottaviani

Review of Economic Studies, 80 (3): 1002-1026, July 2013

Analysis of commitment role of contract cancellation and product return policies when sellers advise buyers about the suitability of the products sold. Effectiveness of competition and consumer protection policies depends on the rationality of customers.

Regulating Financial Advice (2012)

Roman Inderst and Marco Ottaviani

European Business Organization Law Review 13: 237-246

Motivated by recent policy changes across many countries, this review article discusses the rationale for various policies that target financial advice in the market for retail financial services.

- Regulating Financial Advice (638 Kb)

How (Not) to Pay for Advice: A Framework for Consumer Financial Protection (2012)

Roman Inderst and Marco Ottaviani

Journal of Financial Economics, 105(2): 393-411, August 2012

Why are brokers commonly compensated indirectly through contingent commissions paid by product providers rather than through advice fees paid by customers? The effectiveness of various policy interventions are analyzed depending on the rationality of customers.

Financial Advice (2012)

Roman Inderst and Marco Ottaviani

Journal of Economic Literature, 50(2): 494-512, June 2012

Overviews the pros and cons of various policy interventions in the area of financial advice, such as imposing mandatory disclosure, banning commissions, and regulating contract cancellation terms.

- Financial Advice (195 Kb)

Competition through Commissions and Kickbacks (2012)

Roman Inderst and Marco Ottaviani

American Economic Review, 102(2): 780-809, April 2012

Embeds provision of product advice by an information intermediary into Hotelling model of competition; characterizes when caps on commissions, mandatory disclosure, and other policy interventions aimed at subduing the use of commissions have unintended consequences for the efficiency of advice

Consumer Protection in Markets with Advice (2010)

Roman Inderst and Marco Ottaviani

Competition Policy International, 6(1): 47-64, Spring 2010

Accessible introduction prepared for a Symposium on Behavioral Economics

Ex Ante or Ex Post Competition Policy? A Progress Report (2011)

Marco Ottaviani and Abraham Wickelgren

International Journal of Industrial Organization 29 (2): 356-359, May 2011

In the context of merger policy we analyze the choice between ex post control (which is based on the more accurate information that becomes available in the intervening period) and ex ante control (which entails temporary losses to social welfare and reversal costs incurred to unscramble the eggs).

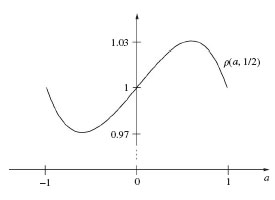

Noise, Information, and the Favorite-Longshot Bias in Parimutuel Predictions (2010)

Marco Ottaviani and Peter Norman Sorensen

American Economic Journal: Microeconomics 2(1), 58-85, February 2010

Testable implications for the sign and extent of favorite-longshot bias depending on the information to noise ratio present in the market, as affected by the number of bettors, the number of outcomes, the amount of private information, the level of participation generated by recreational interest in the event, the divisibility of bets, the presence of ex post noise, as well as ex ante asymmetries across outcomes.

Surprised by the Parimutuel Odds? (2009)

Marco Ottaviani and Peter Norman Sorensen

American Economic Review, 99(5), 2129-2134

The favorite-longshot bias observed in parimutuel markets is consistent with the use of private information by bettors taking simultaneous positions. The ex post realization of a high market probability indicates favorable information about the occurrence of an outcome---and the opposite for longshots.

- Surprised by the Parimutuel Odds? (112 Kb)

Misselling through Agents (2009)

Roman Inderst and Marco Ottaviani

American Economic Review, 99(3), 883-908

How to incentivize sales agents to sell, but not to missell to customers for whom the product is unsuitable? Analysis of the internal organization of the sales process, the commitment effect of transparency of commissions, and the role for self regulation and policy intervention.

- Misselling through Agents (254 Kb)

Information Sharing in Common Agency: When is Transparency Good? (2009)

Norbert Maier and Marco Ottaviani

Journal of the European Economic Association, 7(1), 162-187

When should principals dealing with a common agent share their individual performance measures about the agent's unobservable effort?

Monopoly Pricing in the Binary Herding Model (2008)

Subir Bose, Gerhard Orosel, Marco Ottaviani and Lise Vesterlund

Economic Theory, 37(2), 203-241

Full characterization of monopoly prices and learning dynamics when buyers have binary signals about the quality of the good sold and observe the history of past purchases.

The Promise of Prediction Markets (16/05/2008)

Kenneth J. Arrow, Robert Forsythe, Michael Gorham, Robert Hahn, Robin Hanson, John O. Ledyard, Saul Levmore, Robert Litan, Paul Milgrom, Forrest D. Nelson, George R. Neumann, Marco Ottaviani, Thomas C. Schelling, Robert J. Shiller, Vernon L. Smith, E

Science, 320(5878), 877-878

The ability of groups of people to make predictions is a potent research tool that should be freed of unnecessary government restrictions.

- The Promise of Prediction Markets (127 Kb)

Bank Mergers and Diversification: Implications for Competition Policy (2007)

Albert Banal-Estanol and Marco Ottaviani

European Financial Management, 13(3), 578-590

Risk-averse banks first merge and then compete in the markets for loans and deposits, in the presence of interest rate risk and default risk for individual loans. If depositors have more correlated shocks than borrowers, bank mergers are relatively worse for depositors than for borrowers.

Credulity, Lies, and Costly Talk (2007)

Navin Kartik, Marco Ottaviani and Francesco Squintani

Journal of Economic Theory, 134(1), 93-116

Language inflation and deception result when either the receiver is credulous or the sender finds it costly to misrepresent information (due to legal, technological, or moral constraints)subsumes the first part of working paper Non-Fully Strategic Information Transmission.

- Credulity, Lies, and Costly Talk (259 Kb)

Outcome Manipulation in Corporate Prediction Markets (04/2007)

Marco Ottaviani Peter Norman Sorensen

Journal of the European Economic Association (Papers and Proceedings), 5(2-3), 554-563

Analysis of the amount of outcome manipulation (and impact on prices) resulting in a simple model of a corporate prediction market.

Naive Audience and Communication Bias (12/2006)

Marco Ottaviani and Francesco Squintani

International Journal of Game Theory, 35(1), 129-150

The amount of information that is revealed to strategic receivers increases in the fraction of naive receivers and in the informational advantage of the sender, whereas it decreases in level of the conflict of interestsupersedes the second part of working paper Non-Fully Strategic Information Transmission.

Dynamic Monopoly Pricing and Herding (2006)

Subir Bose, Gerhard Orosel, Marco Ottaviani and Lise Vesterlund

RAND Journal of Economics, 37(4), 912-928

Dynamic pricing by a monopolist selling to buyers who learn from each other’s purchases, with implications for herd behavior and welfare.

- Dynamic Monopoly Pricing and Herding (474 Kb)

Mergers with Product Market Risk (2006)

Albert Banal-Estanol and Marco Ottaviani

Journal of Economics & Management Strategy, 15(3), 577-608

- Mergers with Product Market Risk (255 Kb)

The Strategy of Professional Forecasting (08/2006)

Marco Ottaviani and Peter Norman Sorensen

Journal of Financial Economics, 81(2), 441-466

Framework for modeling strategic behavior of professional forecasters: (1) Concern for perceived talent leads to excessive conformity if the market is naive and loss of information if the market is rational. (2) Competition for best accuracy leads to excessive forecast differentiation.

Reputational Cheap Talk (2006)

Marco Ottaviani and Peter Norman Sorensen

RAND Journal of Economics, 37(1) 155-175

Communication by an expert concerned about appearing to be well informed, part IIgeneral analysis with focus on incentives to deviate from truthtelling, effect of self-knowledge of information quality, and multiple experts speaking simultaneously.

- Reputational Cheap Talk (209 Kb)

Professional Advice (2006)

Marco Ottaviani and Peter Norman Sorensen

Journal of Economic Theory, 126(1), 120-142

Communication by an expert concerned about appearing to be well informed, part Ianalysis of tractable example with focus on characterization of equilibrium, comparative statics, and multiple experts speaking sequentially.

- Professional Advice (272 Kb)

The Transition to Digital Television (2005)

Jerome Adda and Marco Ottaviani

Economic Policy, 41, 160-209

Conceptual and empirical framework for evaluating policies for the transition from analogue to digital television.

- The Transition to Digital Television (619 Kb)

Price Competition for an Informed Buyer (2001)

Giuseppe Moscarini and Marco Ottaviani

Journal of Economic Theory, 101(2), 457-493

Analysis of competition for a buyer with private information on the relative quality of the sellers, with a Hotelling reinterpretation and comparative statics with respect to buyer’s private information and public information.

The Value of Public Information in Monopoly (2001)

Marco Ottaviani and Andrea Prat

Econometrica, 69(6), 1673-1683

When does a price-discriminating monopolist want to reveal public information to its buyers? The linkage principle meets mechanism design by an informed principal.

Information Aggregation in Debate: Who Should Speak First? (2001)

Marco Ottaviani and Peter Sorensen

Journal of Public Economics, 81(3), 393-421

Dynamics of group think in a committee with members concerned about their reputation for expertise, with implications for the organization of debate.

Herd Behavior and Investment: Comment (2000)

Marco Ottaviani and Peter Sorensen

American Economic Review, 99(3), 695-704

Paper (i) uncovers the close connection between reputational and statistical herding and (ii) shows that reputational cascades also result when better informed agents do not have access to signals that are more positively correlated conditional on the state.

Social Learning in a Changing World (1998)

Giuseppe Moscarini, Marco Ottaviani and Lones Smith

Economic Theory, 11, 657-665

Only temporary informational cascades can arise if the state of the world is changing stochastically over time during the learning process.

- Social Learning in a Changing World (182 Kb)